All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money worth of an IUL are commonly tax-free as much as the quantity of premiums paid. Any type of withdrawals above this quantity might undergo tax obligations depending upon plan structure. Typical 401(k) payments are made with pre-tax dollars, decreasing gross income in the year of the contribution. Roth 401(k) contributions (a strategy attribute offered in a lot of 401(k) plans) are made with after-tax payments and then can be accessed (earnings and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at least 5 years and the individual mores than 59. Assets withdrawn from a conventional or Roth 401(k) before age 59 might sustain a 10% fine. Not specifically The insurance claims that IULs can be your very own bank are an oversimplification and can be misdirecting for many factors.

You might be subject to upgrading associated wellness questions that can affect your recurring prices. With a 401(k), the cash is always yours, including vested employer matching despite whether you quit contributing. Danger and Assurances: First and foremost, IUL policies, and the cash worth, are not FDIC insured like conventional savings account.

While there is generally a flooring to stop losses, the development capacity is topped (implying you may not fully gain from market growths). The majority of experts will agree that these are not similar items. If you desire survivor benefit for your survivor and are concerned your retirement savings will certainly not suffice, after that you may desire to think about an IUL or various other life insurance policy item.

Sure, the IUL can supply access to a cash account, but again this is not the key function of the item. Whether you want or need an IUL is a highly specific concern and relies on your key financial goal and goals. Listed below we will try to cover advantages and limitations for an IUL and a 401(k), so you can even more mark these items and make a much more enlightened choice pertaining to the finest method to handle retirement and taking care of your enjoyed ones after death.

Index Universal Life Insurance Reviews

Funding Costs: Financings versus the policy build up interest and, if not settled, lower the survivor benefit that is paid to the beneficiary. Market Engagement Restrictions: For the majority of plans, financial investment growth is linked to a stock exchange index, yet gains are normally covered, restricting upside potential - indexed universal life insurance dave ramsey. Sales Practices: These policies are often offered by insurance coverage agents that may highlight advantages without fully discussing prices and threats

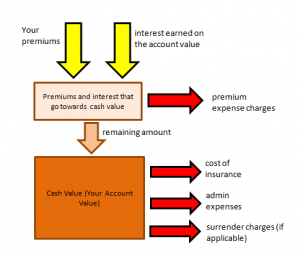

While some social media pundits recommend an IUL is a substitute item for a 401(k), it is not. Indexed Universal Life (IUL) is a type of permanent life insurance coverage plan that also supplies a cash worth part.

Latest Posts

Universal Life Insurance

Iul 是 什么

Indexed Universal Life Insurance